We have prepared tens of thousands of business and individual tax returns over the years and have seen it all when it comes to tax returns. We help businesses and individuals take advantage of deductions and credits by providing tax planning, compliance, and tax return preparation services.

Please see below for more information about all of our tax-related services.

These tasks form the solid foundation of your small business financial record keeping system. You can customize the package of services you receive by adding payroll, tax planning, tax preparation, or any of our other services.

Preparing your own income tax return can be a task that leaves you with more questions than answers. Incorrectly preparing a tax return can cost you thousands of dollars in missed deductions, poor planning, and potentially trigger intrusive future audits.

Businesses should always speak to a tax expert regarding their returns because it is important they are filed timely and correctly. The staff at Xcellent Tax have prepared thousands of returns and we are experienced with all of the tricks of the trade, terminology, and common pitfalls that small businesses encounter with their tax returns.

Even for individuals, today’s tax laws are so complicated that filing a relatively simple return can be confusing. It is just too easy to overlook deductions and credits to which you are entitled. Even if you use a computer software program there’s no substitute for the assistance of an experienced tax expert with whom you can speak directly.

With our tax preparation services, you receive the following services:

- We prepare business returns while reviewing the businesses financials and prior tax returns to ensure accuracy.

- Your tax return will be checked and rechecked by our computer software identifying potential problems the IRS may look at more closely and reviewing the math to limit IRS triggers.

- Your tax return can be filed electronically so you will get a refund back quicker.

- An experienced tax expert will sign off on your return.

- We will show you potential deductions to limit your tax liability for next year.

Books a Mess? No Problem!

If you own a small business and haven’t kept up your bookkeeping, don’t worry. We can help you. We’ll prepare your bookkeeping for the year, prepare a full Schedule C, as well as your personal income tax return. Then we’ll help you set up an easy system that allows you to keep your books in tip-top shape next year. Please see our small business financial record keeping services for more information.

Planning is the key to successfully and legally reducing your tax liability. We go beyond tax compliance and proactively recommend tax saving strategies to maximize your after-tax income.

We make it a priority to enhance our mastery of the current tax law, complex tax code, and new tax regulations by attending frequent tax seminars.

Businesses and individuals pay the lowest amount of taxes allowable by law because we continually look for ways to minimize your taxes throughout the year, not just at the end of the year.

We recommend Tax Saving Strategies that help you…

- grow and preserve assets by keeping Uncle Sam out of your pockets.

- defer income so you can keep your money now and pay less taxes later.

- reduce taxes on your income so you keep more of what you make.

- reduce taxes on your estate so your family keeps more of what you’ve made.

- reduce taxes on your gifts so you can give more.

- reduce taxes on your investments so you can grow your wealth faster.

- reduce taxes on your retirement distributions so you can retire in style.

Here’s just a few of the Tax Saving Strategies we use…

- Splitting income among several family members or legal entities in order to get more of the income taxed in lower bracket.

- Shifting income or expenses from one year to another in order to have them fall where it will be taxed at a lower rate.

- Deferring tax liabilities through certain investment choices such as pension plans, contributions and other similar plans.

- Using certain investments to produce income that is tax exempt from either federal or state or both taxing entities.

- Finding tax deductions by structuring your money to pay for things you enjoy, such as a vacation home.

Remember, we work for you not for the IRS. Many of our clients save many times our fees in reduced tax liability through careful planning and legitimate tax strategies. Please contact us at meet with one of our tax experts for more information.

Tax Problems

Are you having problems with the IRS?

We’re here to help you resolve your tax problems and put an end to the misery that the IRS can put you through. We pride ourselves on being very efficient, affordable, and of course, extremely discreet. The IRS problems will not just go away by themselves; they just keep getting worse with penalties and interest being added each day.

If you owe the IRS, you have a very serious problem. It may take the IRS several years to catch up to you, but they’re relentless and have no mercy in collecting all the money that is owed. When the collection process starts, they’ll make your life miserable and literally ruin all aspects of your life.

We offer the following IRS problem resolution services:

Texas Sales and Use Taxes

State Sales and Use Tax is imposed on all retail sales, leases and rentals of most goods, as well as taxable services. In Texas, some businesses are required to report and pay sales tax on a monthly or quarterly basis. We work with our clients to handle all of their sales and use tax issues.

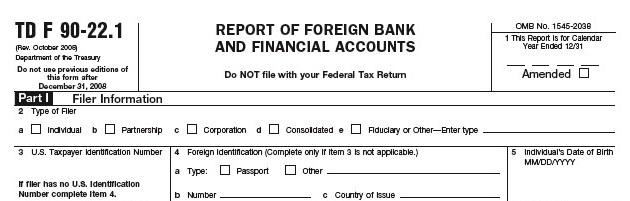

If you have a financial interest in or signature authority over a foreign financial account, including a bank account, brokerage account, mutual fund, trust, or other type of foreign financial account, the Bank Secrecy Act may require you to report the account yearly to the Internal Revenue Service by filing Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts (FBAR).

The FBAR is required because foreign financial institutions may not be subject to the same reporting requirements as domestic financial institutions. The FBAR is a tool to help the United States government identify persons who may be using foreign financial accounts to circumvent United States law. Investigators use FBARs to help identify or trace funds used for illicit purposes or to identify unreported income maintained or generated abroad.

Civil Penalties. The civil penalty for failing to file an FBAR is $10,000 for each non-willful violation. But note that the government can apply this penalty per account and per year. That means your penalty exposure goes up the more accounts you have and the more years you fail to comply.

If your violation is considered willful, the potential penalties get even more Draconian. If a violation is willful, the penalty is the greater of $100,000 or 50% of the amount in the account for each violation. Again, each year you didn’t file is a separate violation.

Criminal Penalties. Tax evasion can carry a prison term of up to five years and a fine of up to $250,000. Filing a false return can mean up to three years in prison and a fine of up to $250,000. Failing to file a tax return can mean a one year prison term and a fine of up to $100,000. Failing to file FBARs can be criminal too with monetary penalties up to $500,000 and prison for up to ten years.

FBARs are important to the IRS enforcement efforts regarding foreign accounts and income tax compliance. They will probably become more so. Xcellent Tax can help you complete the FBAR and represent you in FBAR enforcement actions with the Internal Revenue Service. We have experience helping clients’ in difficult FBAR enforcement actions and have helped reduce FBAR related penalties.